Lately, it seems like everywhere you turn, crew members are out of work. As of July 2024, BECTU, the UK’s media and entertainment trade union, reported that a staggering 52% of UK film and TV workers were unemployed. At Behind The Budget, we believe that to understand where the industry is headed, we need to look back—comparing where it was supposed to go with where it stands now. We’re lifting the petticoats of the industry, so to speak, revealing the key trends in production volume, expenditure, and employment. By examining how we arrived at this point and the challenges that lie ahead, we aim to shed light on whether there’s a way forward for a thriving UK film and TV industry. Let’s dive in.

Production Volume and Spending: The Link to Employment

Examining the relationship between production volume and expenditure gives us insight into the twists and turns of today’s job market. At its core, higher production volumes mean more jobs—simple enough, right? Every production requires a variety of roles, and bigger budgets allow for more specialised positions, from advanced visual effects artists to on-set safety professionals. More money in the budget means productions can employ larger teams, extend shooting schedules, and ultimately provide longer, more stable employment. For workers, this isn’t just a salary; it’s job security.

Inward investment, particularly from international projects, makes a huge difference. More money flowing in from abroad fuels infrastructure development, creating opportunities that ripple throughout the industry. From studios to equipment rentals, the benefits spread far and wide. But when production volume drops, as we’ve seen recently, job stability goes with it. Lower budgets lead to smaller crews, shorter schedules, and a squeeze on freelance and contract roles. Production volume and expenditure are deeply intertwined with job market dynamics, impacting not just the number of jobs but also their quality and stability.

COVID-19’s Impact and the Streaming Surge

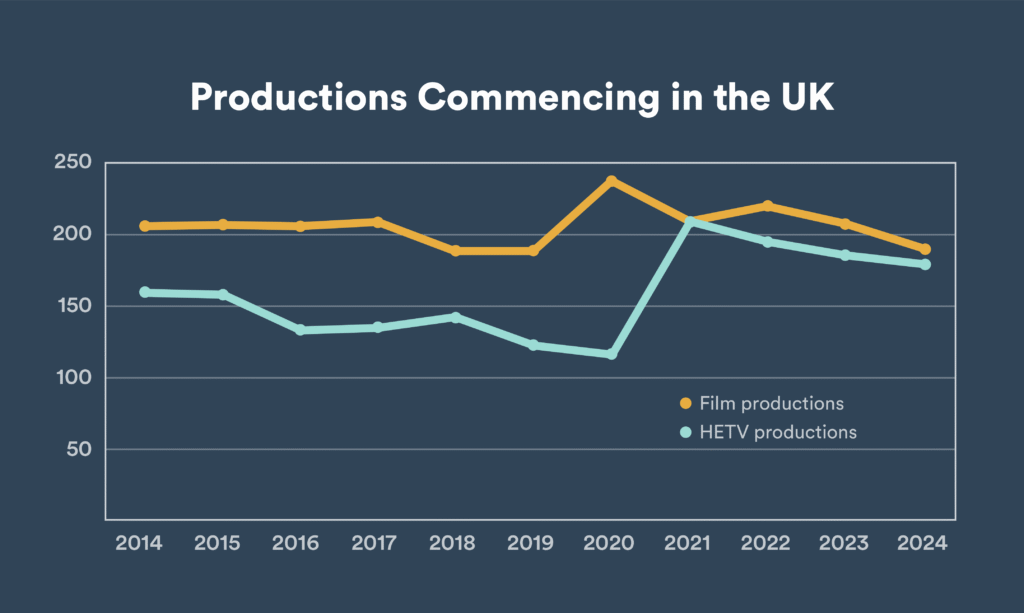

Looking back over the last decade [Graph: Productions Commencing in the UK], we see a sharp rise in production in 2020, followed by a drop-off that begins around 2022. When the UK entered a strict lockdown in March 2020, everything ground to a halt for three or four months. By June, productions started to resume under new safety guidelines, and by July and August, the UK was back in full swing—well ahead of much of the world.

The lockdown had a profound effect on how we consumed content. Streaming was already on the rise, but in 2020, on-demand viewing skyrocketed. Suddenly, we were all binge-watchers, soaking up content at an unprecedented rate. Blockbusters pivoted to hybrid or direct-to-streaming releases. Nostalgic, comfort-driven content surged in popularity, while international and diverse programming found new audiences as viewers branched out beyond traditional releases.

This combination of pent-up demand, early reopening, and streaming’s growth created the perfect storm for the production industry. With projects piling up and a voracious appetite for fresh content, productions surged in the UK. Jobs opened rapidly, and crew members were fast-tracked into roles to meet demand. Volume and investment records were shattered, with high-budget

projects pouring into the UK and setting new industry benchmarks.

The Strike That Brought Production to a Standstill

Then, reality hit. Many industry contracts—covering writers, actors, and crew—were outdated and not

equipped for the streaming era. The 2023 SAG-AFTRA strike was about more than just streaming profits. It was a call for fair pay, protections against AI, better working conditions, and transparency from streaming platforms. Yes, streamers’ profits highlighted the disparity in compensation, but the strike was really about actors’ livelihoods and career sustainability. In the UK, the impact was huge: 118 days of strikes led to job losses across the board, with BECTU reporting that 75% of film and TV workers were out of work during that period.

Post-Strike Recovery: Why Aren’t Jobs Bouncing Back?

After the strikes ended in November 2023, many expected a quick rebound. But so far, that’s been wishful thinking. The UK industry is now tightly linked to US productions, meaning we’re waiting for American studios to clear their backlogs before new projects begin. On top of that, delays in green-lighting and scheduling have only made things harder. While production expenditure has started to recover, spending alone isn’t enough to fix the employment crisis.

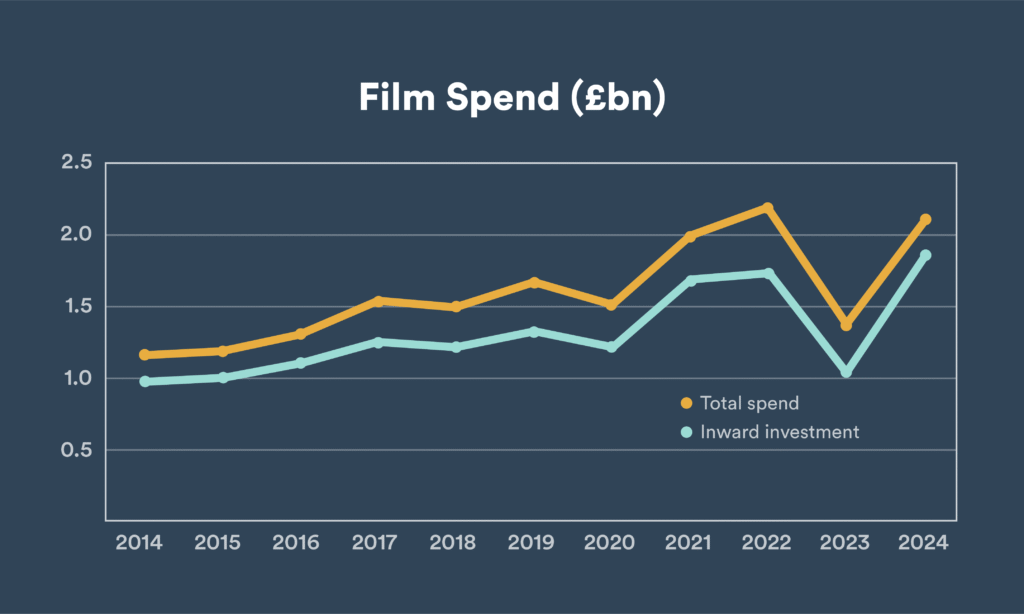

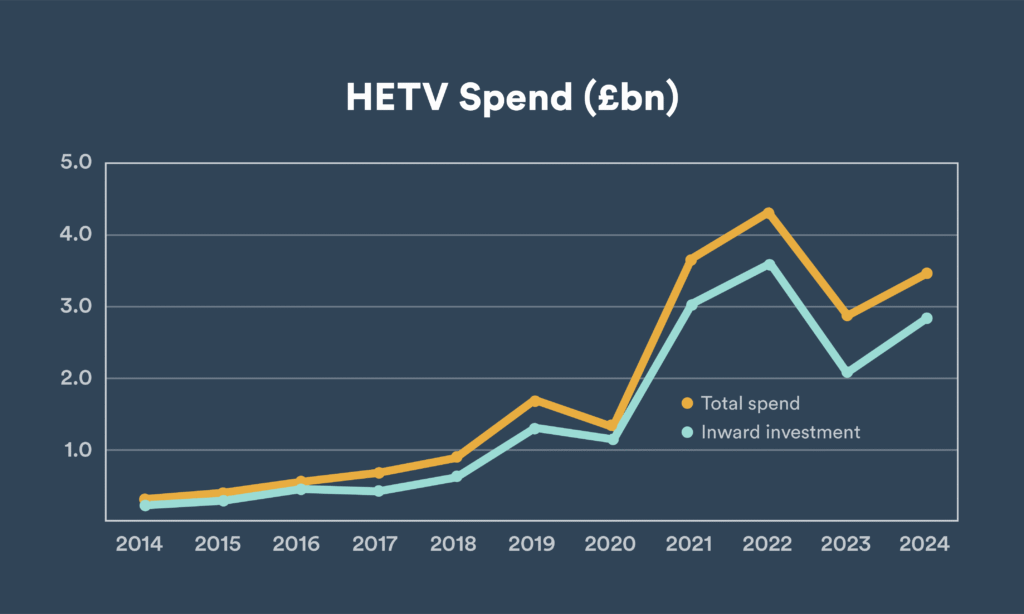

At the end of 2024 and into early 2025, the industry appears to be stabilising, with production spend and inward investment aligning more closely with pre-pandemic projections. The latest BFI figures show a significant recovery in both film and high-end TV expenditure, suggesting that the downturn following the strikes and economic uncertainty is easing. If we follow the trajectory of inward and total spend on both graphs, 2021 and 2022 emerge as anomalies, and we are now slightly below where we would have been had COVID-19 not disrupted the industry.

But if spending is back on track, why is so much of the workforce still struggling to find work? The answer isn’t just smaller budgets—it’s structural. While production volumes remain stable, spending hasn’t returned to its peak, meaning leaner crews and a shift in hiring priorities. During the post-pandemic boom, the industry expanded rapidly to meet demand, accelerating career progression as mid-level crew were needed to fill gaps. Now, with tighter budgets, productions are prioritising highly skilled, experienced crew, leaving a surplus of mid-tier professionals and an industry grappling with a skills imbalance. What was once an urgent shortage has now become an oversupply, creating a challenging job market for many.

Future Outlook and Industry Predictions

Looking ahead, the UK film and TV industry stands at a crossroads. On one hand, it remains one of the world’s premier production hubs, with strong infrastructure, skilled talent, and high demand for content. On the other, rising costs and international competition could limit growth. To stay competitive, the UK must adapt its incentives, streamline production processes, and invest in workforce development to tackle skill shortages.

The UK has reinvented itself before—can it do it again, or will rising competition take the spotlight?

Graphics by R Frost

BFI. UK Film & High-End TV Production Spend Statistics

https://www.bfi.org.uk/industry-data-insights/statistics/uk-film-production-statistics

BFI. Full Statistical Yearbook: Screen Industry Data

https://www.bfi.org.uk/industry-data-insights/statistical-yearbook

ScreenSkills. Labour Market and Skills Reports

https://www.screenskills.com/insight/reports/

Pact. Independent TV and Film Sector Trends

https://www.pact.co.uk/resources/reports.html

Creative UK. Screen Sector Recovery and Policy Recommendations

https://www.wearecreative.uk

Variety. UK Production Hits Record Highs

https://variety.com/t/uk-production/

UK Government. Audiovisual Expenditure Credit (AVEC) & Creative Tax Relief Guidance

https://www.gov.uk/government/publications/audiovisual-expenditure-credit-guidance

Behind the Budget. Understanding Production Finance – How Film Financing Works

https://behindthebudget.com/courses/understanding-production-finance

Behind the Budget. How the UK Tax Credit Works – A Jargon-Free Guide for Producers

https://behindthebudget.com/courses/how-the-uk-tax-credit-works

Providing practical courses designed to help you grow professionally and achieve your career goals in the film and TV production industry

Behind The Budget uses cookies to enhance your browsing experience, analyse site traffic, and provide relevant content. By clicking “Accept All,” you consent to our use of cookies. You can manage your preferences or read more in our Cookies Policy.